An Opinion on Vet Care Through 2035: Specialists, corporates & costs (#394)

- Rick LeCouteur

- Aug 18

- 4 min read

From 2026-2035 specialty care will keep expanding, corporate ownership will remain influential (and more regulated), and prices will likely outpace general inflation. The winning systems will pair scale with transparency, outcomes, and strong GP–specialist collaboration.

Why the specialist wave keeps growing

Two engines drive specialist growth:

Medicine got more complex and more available. MRI/CT, interventional cardiology, precision oncology, advanced pain/rehab now reside in regional hubs rather than only at universities.

Client expectations rose. As pets moved from backyard to bedroom, demand for human-grade care followed; insurance penetration, while still modest, keeps inching up and enables higher-acuity choices.

What this means

Expect a hub-and-spoke map by 2035.

24/7 anchor hospitals (ICU, advanced imaging, interventional) with satellite clinics for consults, rechecks, rehab, and scheduled visiting specialists in some regions.

Simulation-heavy residencies, strong career advancement opportunities for veterinary technicians, and AI co-pilots (triage, radiology pre-reads, anesthesia decision support) shorten time to safe proficiency, without replacing judgment.

Corporate ownership by 2035

Consolidation will remain meaningful in the U.S. and very high in the U.K./EU, but with firmer guard rails.

The UK’s Competition & Markets Authority (CMA) is running a formal investigation into small-animal vet services, extended to early 2026, with remedies under consultation (price transparency, Rx portability, and other consumer protections).

Large groups will keep anchoring ER/specialty hubs where capital intensity (MRI, cath labs, ICU staffing) favors scale. The trade-off is governance: clearer disclosures, outcomes reporting, and referral-choice protections. Even Initial Public Offerings (IPOs) will be weighed against regulatory outcomes (e.g., IVC Evidensia).

By 2035, expect corporate networks to dominate high-acuity care and a sizable share of primary/urgent care in metropolitan areas, with independents thriving on access, continuity, and transparent pricing. The regulatory climate, especially in the UK, pushes everyone toward clearer estimates, Rx options, and published quality metrics.

What care costs today (2025 snapshot)

Pet-industry spend: APPA pegs total U.S. spend at $157B projected for 2025 (all categories).

Insurance: Average U.S. premiums in 2024 were about $749/yr for dogs and $386/yr for cats (accident/illness). Growth continues, but adoption is still low overall.

Price trend: The Bureau of Labor Statistics veterinarian services index is running ~6.4% Year on Year in 2025, well above headline inflation.

Where prices are (likely) headed (2000–2035)

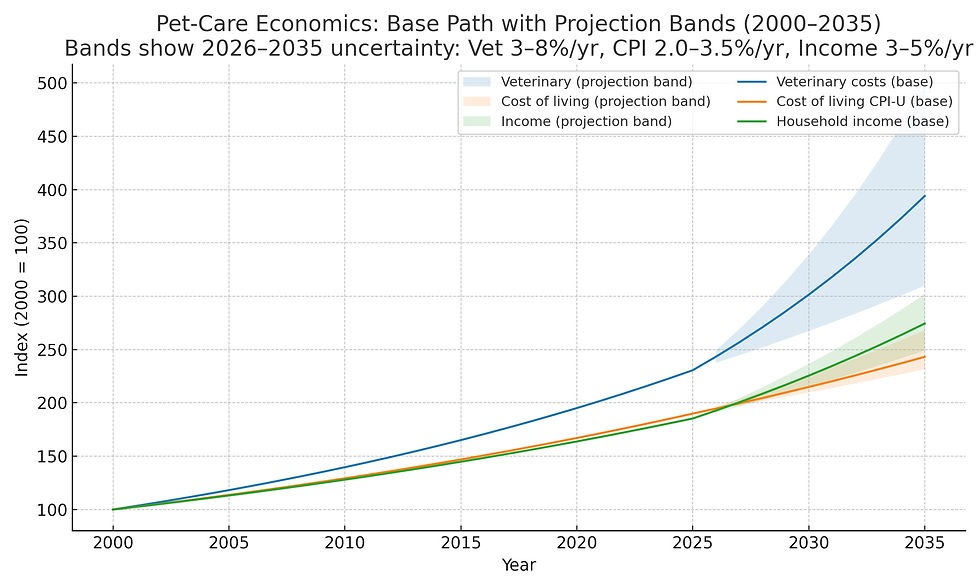

The figure below tracks three indices:

Veterinary costs (CPI “veterinarian services” proxy) [BLUE LINE]

Cost of living (CPI-U, all items) [RED LINE]

Annual income for pet owners (nominal median household income proxy) [GREEN LINE]

2006-2035 is a projection with bands:

Veterinary costs: base +5.5%/yr, band +3% to +8%

Cost of living (CPI-U): base +2.5%/yr, band +2.0% to +3.5%

Household income: base +4.0%/yr, band +3% to +5%

Read it this way: Even if general inflation cools, veterinary prices will likely outpace CPI. Income growth helps, but without insurance/financing, the gap widens, especially for ER/specialty episodes. (The BLS tables show why that base path is plausible).

2035 price yardsticks

Using the 2025 ranges most pet owners see today as a base, here’s a 2035 most likely view.

Routine GP visit: $120–$300

Wellness visit with vaccinations/tests: $255–$510

Dental cleaning (no major extractions): $510–$3,415

ER exam fee: $170–$405; common ER visits often $510–$2,050+ depending on diagnostics/treatment

X-rays: $255–$425

Ultrasound: $510–$1,025

Blood panel: $135–$340

Laceration repair: $1,365–$4,270

TPLO (knee): $5,125–$13,665

Intervertebral disc surgery: $8,540–$20,500

Why these ranges? They apply the base growth path above to typical 2025 prices; real-world quotes will swing with geography, clinic type, and case complexity.

What to do about it

For pet owners

Ask for a range and re-estimate when plans change.

Consider pet insurance (or employer pet benefits) for budgeting; review caps, exclusions, and pre-authorization on big cases.

For general practitioners

Build a consult-first referral culture; send structured packets (problem list, labeled imaging, medications) and request same-day discharge summaries back.

Publish transparent price ranges and offer financing; track your own outcomes and re-estimate fidelity.

For specialists & hospital networks

Report case-mix–adjusted outcomes (e.g., TPLO complications, IVDD return-to-walk) and average time-to-estimate; integrate tele-ICU/post-op monitoring to shorten stays.

Expand visiting-specialist days to shrink regional deserts.

For policymakers & professional bodies

Encourage interoperability standards (records/imaging handoff).

Advance transparency remedies already under review in the UK (price/Rx options) while protecting referral choice and clinician autonomy.

Rick’s Commentary

By 2035, you should expect:

Deeper specialization

Scaled but more transparent corporate players, and

Prices ~70% higher than today in a base case, and higher still for advanced ER/specialty.

The counterweight is clear:

Publish outcomes

Align GP–specialist handoffs

Broaden insurance/financing access, and

Keep clients in the loop with estimates that update when the plan does.

Sources

Inflation & prices: U.S. Bureau of Labor Statistics CPI tables; veterinarian-services YoY ≈ 6.4% in 2025; CPI-U July 2025 release. https://www.bls.gov/news.release/cpi.t02.htm?utm

Pet spending: APPA 2025 projected total = $157B (all categories). https://americanpetproducts.org/industry-trends-and-stats?utm

Insurance: NAPHIA State of the Industry—2024 average premiums and market growth. https://naphia.org/industry-data/section-3-average-premiums/?utm

Corporate/regulatory context: UK CMA investigation timeline and remedies consultation (2025). https://www.gov.uk/cma-cases/veterinary-services-market-for-pets-review?utm

Comments